Everyone knows that the cost of college has skyrocketed over the past few decades, and also that it’s better to take classes taught by tenure-track faculty and a damned shame that all these fricking TAs are leading sections. It’s just common knowledge. Kevin Carey of the New America Foundation’s Education Policy Program tells us what we already know in this interview on NPR’s Fresh Air. (NB: I’m on Malawian cell-phone internet right now so I just read the article and can’t listen to the actual recording, but the article is mostly verbatim quotes from Carey).

Unfortunately, neither of these facts are particularly backed up by the evidence. The latter point is kind of weird to begin with: have any of the people bemoaning the rise of lecturers in teaching actually taken any classes taught by faculty on the tenure track? Adjuncts and lecturers are hired for, and evaluated on, their teaching. I’ve had almost uniformly good experiences in their classes. Tenure-track professors, on the other hand, are paid for and focused on their research. Some are amazing teachers, especially for graduate-level courses, but back when I was an undergrad I had lots of professors who were awful teachers. Carey even admits as much later in the article, so why make this hackneyed complaint about adjuncts? If we want to improve higher education, one place to start would be to give this much-maligned group credit for being the dedicated and highly-qualified educators they are, rather than deferring to the archaic status system of academia.

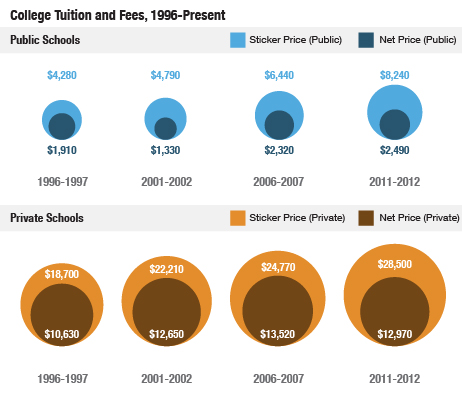

But costs are definitely rising, right? I wouldn’t be so sure: the alleged increases of inflation + 4% are the sticker price of college, not the cost people actually pay, which includes grants and financial aid. Those prices have been rising far slower than the sticker price, and for private universities have actually fallen in nominal terms, according to this graph (ironically taken from a different NPR article which I found via Susan Dynarski):

That doesn’t include room and board, but financial aid can help with those ancillary costs as well. Assuming I’m reading it properly (the article is sparse on details) then the true price of college has risen slower than inflation and has actually fallen in real terms for both public and private schools. That’s very different from the take you typically get in stories like the Carey interview.

The only downside to this positive trend is that not enough people are aware of how much financial aid is available to them, and often the worst-informed prospective students come from the poorest families. It does them a major disservice to harp on the huge and rising costs of a college education without also noting that very few people pay full price. One reason for America’s poor college attendance figures is that while people understand the payoffs to a degree, they overestimate the costs. This hits disadvantaged students the hardest – they stand to benefit the most from financial aid and tend to understand it the worst – but even the well-off need help figuring out what college actually costs and learning how to work the system in their favor. One of my dad’s businesses focuses on coaching students and their parents through the college application process, and the area where people consistently need the most help is in understanding costs, financial aid and scholarships.

Hat tip: My mother, via email

There are many ways to calculate the cost of an item or service…actual dollars, percentage of annual income, or in comparison to other desirable products or services (opportunity cost).

One foundational issue here is the rise of “student debt”, as that is a true opportunity cost. Dollars spent today with borrowed money have to be repaid (theoretically) with future dollars. A college graduate with loan payments cannot buy a car or a house with the same dollar needed to repay the loan.

Without doing significant research, I would venture that, over the lastt 25 years, the cost of higher education has increased dramatically as a percentage of household income.

The driving force for this rise in cost is cheap money – delivered through subsidized student loan programs. There is no better way to make an item scarce (or more expensive in relative terms) than to make it “free”. That is exactly what the current loan programs have done…and at the same time, burdened many young people with debts that are not easily repaid. This cheap money has also financed a boom in education-based spending by the industry…an economic bubble that will eventually burst as trends revert to the mean…as all bubbles do. All this is driven on the precept that an education is the key to “the good life”.

The bottom line is that, yes, an education is critical to thriving in a competitive world…broaden your definition of education to include opportunities beyond the walls of the Ivy League industry.

And avoid too much persopnal debt…your days will be brighter and you’ll sleep well at night.

Chris, I believe that the “net price” in that graph excludes only the portion covered by grants and scholarships, and so would still include any amount for which students or their parents take out loans. That would imply that university costs are actually falling as a share of household income. But I’m not sure, and the underlying article is too sparse on details. In either case, the numbers that should be reported are the total cost of attendance (tuition + room & board) net of scholarships, and it’s a big problem that those figures aren’t what show up in the media.

>And avoid too much persopnal debt…your days will be brighter and you’ll sleep well at night.

This is particularly telling coming from a financial planning expert. Economists emphasize the use of loans to smooth consumption over the life course – telling people to borrow out of their future earnings in order to live better, and invest in your education, today. I still think that’s a good strategy, but the stress associated with huge debt burdens shouldn’t be ignored. Loans have costs beyond just the financial ones.

That said, all debts are not born equal. A large student loan debt will quickly be outpaced, in terms of cost and stress, by a far smaller amount owed to credit card companies. Huge credit card debts are a much bigger issue for young Americans than student loans, at least based on what I see among my friends.

I suspect that the issues you discuss here are only compounded by the sources from which we derive most of our information about the cost of a university degree. There seems to be no real middle ground between the peppy “you are sure to get a scholarship that covers 99% of your costs” camp and the maudlin “you haven’t a chance, turn back now” crew. If you get your pre-application from the peps, you might be led to believe that planning for the financial burden of college is unnecessary (I, for example, went off to uni on a full ride scholarship and still had to call home once a month to cover the absurd cost of rent in my college town). Alternatively, if you listen mostly to the doomsayers, you could choose avoid the scary and burdensome world of higher education all-together.

As for the quality of university education, I find the above-mentioned NPR talk fails to account for variation in the product supplied by different institutions of higher-learning. Once you get over the hump of admissions (admittedly a Mt. Everest sized hump that I am blithely ignoring here), people self-select into an environment that they feel best suits their needs and this includes the percent of classes featuring adjuncts vs. tenured profs, the number of TA-led sessions, and even the cost of education. Dare I say that the “tenured vs. adjunct” debate is something that people outside of the university system care much more about than college students themselves? N=1 note, the teacher that had the greatest impact on my post-university life was a PhD student who had taken on a small-seminar class in order to prepare for her tenure-track position at another university.

>full ride scholarship

The NCAA keeps using that word. I do not think it means what they think it means.

>Dare I say that the “tenured vs. adjunct” debate is something that people outside of the university system care much more about than college students themselves?

That’s probably true, but it still takes freshmen a while to realize that lots of the awesome teachers are lecturers and adjuncts. And that rigid hierarchy, even if students see past it, still really bugs me because it doesn’t afford talented people the respect they deserve.