Joe Golden shared this Atlantic piece on the evolution of airfares, and the way airfare is priced now. It reaches the same conclusion I have: airline tickets are a very strange market, characterized by many constraints, limited competition between sellers, and, most important, nothing close to the classic “law of one price”. If a gas station tried to charge you twice as much as the next guy in line, you’d probably throw punches, but that kind of pricing is pretty typical on airplanes.

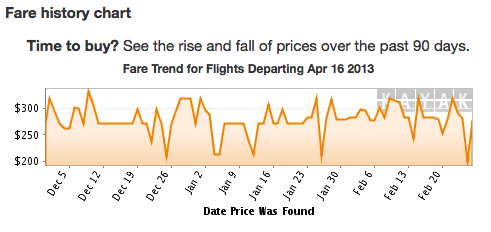

The article also has a nice graph that illustrates some of the random-looking price fluctuations that you see in airfares:

The above chart is for a single route, departing on a single day. The time axis shows the date of a search for a fare on that route. Bearing in mind the human tendency to spot patterns in total noise, there appears to be a slowly-increasing regular fare of about $275, with a lot of large fluctuations from that level. Big downward spikes are definitely evident, and this might be masking their size (if what’s shown are daily averages, and the spikes are mixed with higher prices on a given day).

There are also upward spikes, consistent with anecdotes reported to me by a number of people. I’ve seen things like them myself. Michel, commenting on my last post, argues that these could be (false) signals sent by the airlines to indicate that flights are selling out. I agree that this is probably going on. The basic story is that you’re searching for a given flight, see a fare of $500, and decide to keep looking. Then you see a price of $1200. Crap! You start to freak out about the $700 you just lost. Maybe you open another browser or switch to incognito mode or delete your cookies. The next price you see is back down to $550 – thank god – and you buy it immediately to be safe. The airline has fooled you into taking their first offer, and even nudged you upward a bit. This is an interesting variation on price discrimination, one based on consumer psychology instead of income or demographics.

I differ with Michel’s conclusion that they are evidence for Valendr0s’s model (of exploiting cookies to track a given customer). An airline can try to scare potential customers by throwing in such upward spikes purely at random. It’s not clear that cookies give it any additional traction on this: if anything, a dedicated refresher like myself is signaling a lot of patience.

[Semi-technical aside: Michel also notes that my model has incomplete information on one side of the market. This is absolutely true, and in reality I think that incomplete information is the rule on both sides of the airline ticketing market. This drives all kinds of signaling by both sides. Sometimes I wonder about outright lies: when Kayak tells me there are only 2 seats left, are there any consequences if that’s not true?]

Random fluctuations around a fairly-high base price allow airlines to split the market into three segments, based on consumer preferences and psychology. The normal consumers will just take the base price or the low price as soon as they see it. Dedicated cheap types like myself will ride the refresh button until they get a low offer, while cautious cheap types will take the base price, or even a slightly higher one, if they see the high price offered first. The story is getting richer and better-able to fit the facts, but we still need a data-scraping experiment (that randomly changes whether cookies are set) to test the different models on the table.

jason, as a “dedicated cheap type” like yourself, i would love to see your data scraping experiment!